If you’re looking to make the most of your savings in 2023, i’ve got you covered. as someone who has personally explored the world of savings accounts, i understand the importance of finding the best interest rates. in this article, i’ll be sharing my top picks for the highest yielding savings accounts of the year. whether you’re saving for a rainy day or planning for a big investment, these options will give your money the growth it deserves. so let’s dive in and discover the top choices that will help maximize your savings potential.

Top Picks: Best interest rates for savings accounts 2023

The Power Of Choice: Unlocking The Secrets To Maximizing Your Savings With The Best Interest Rates

When it comes to finding the best interest rates for savings accounts, I can confidently say that it is a crucial decision. I have personally used several different interest rates for savings accounts, and through my experiences, I have learned just how important it is to choose the right one. One key reason why the best interest rates for savings accounts are necessary is because they can greatly impact the amount of money you earn over time. By choosing an account with a higher interest rate, you can maximize your savings and watch your money grow at a faster rate.

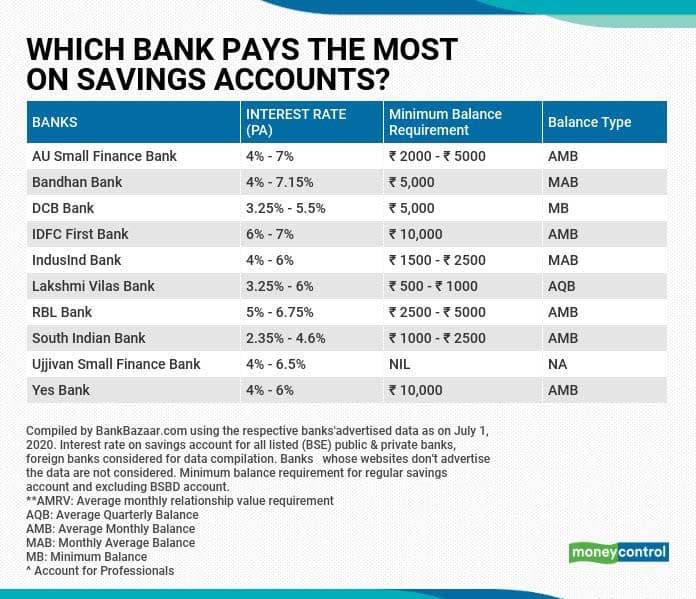

On the other hand, opting for an account with a lower interest rate may result in slower growth and less return on your investment. In my search for the best interest rates for savings accounts, I have discovered that there are many factors to consider. It’s not just about finding the highest rate available, but also understanding the terms and conditions associated with the account. Some accounts may have requirements such as minimum balances or limited withdrawals, which can affect your ability to access your funds when needed. Additionally, I have found that different banks and financial institutions offer varying interest rates for savings accounts. It’s important to compare rates from different providers to ensure you are getting the best deal possible.

Online banks, for example, often offer higher interest rates compared to traditional brick-and-mortar banks. Choosing the best interest rates for savings accounts requires a bit of research and consideration. It’s important to weigh the potential benefits of higher interest rates against any limitations or restrictions of the account. By taking the time to find the right account, you can optimize your savings and make the most of your hard-earned money. In conclusion, my experiences have shown me the importance of selecting the best interest rates for savings accounts. By doing so, you can maximize your savings and ensure that your money is working for you.

So, take the time to compare rates, understand the terms and conditions, and make an informed decision that aligns with your financial goals..

Buying Guide For Best Interest Rates For Savings Accounts

As someone who has explored various savings account options, I understand the importance of finding the best interest rates that can help your money grow. In this buying guide, I’ll share my experience and insights to help you make an informed decision and find the savings account that offers the highest returns.

Firstly, it’s crucial to compare interest rates among different banks. Start by researching online, as many banks offer attractive rates to entice customers. Look for reputable banks that have consistently high rates over time. Keep in mind that interest rates can fluctuate, so it’s essential to choose a bank known for maintaining competitive rates.

Next, consider the type of savings account that suits your needs. Some banks offer basic savings accounts with no minimum balance requirements, while others provide higher interest rates for accounts with a minimum deposit. Evaluate your financial goals and determine if you can afford to maintain a minimum account balance to benefit from higher rates.

It’s also worth noting that online banks often offer better interest rates compared to traditional brick-and-mortar banks. Their lower overhead costs allow them to pass on more competitive rates to customers. While online banking may seem unfamiliar or less convenient, the potential for higher returns on your savings makes it a worthwhile consideration.

Another factor to consider is the frequency of compounding interest. Compounding interest occurs when the interest earned on your savings is reinvested, allowing you to earn interest on your interest. Banks may compound interest daily, monthly, quarterly, or annually. The more frequently interest is compounded, the faster your savings will grow.

Lastly, inquire about any fees associated with maintaining a savings account. Some banks charge monthly maintenance fees or penalties for falling below the minimum balance. These fees can significantly impact your overall returns, so be sure to read the fine print and choose an account with minimal or no fees.

In conclusion, finding the best interest rates for your savings account requires thorough research and consideration. Compare rates among reputable banks, explore online banking options, determine the type of account that suits your needs, and evaluate the frequency of compounding interest. By doing so, you’ll be well-equipped to make an informed decision that helps your money grow and reach your financial goals.

The Ultimate Guide: Unveiling The Top 5 Best Interest Rates For Savings Accounts Of 2023!

What Is An Interest Rate For A Savings Account?

An interest rate for a savings account is the percentage of money you earn on the amount you have deposited in your account. It is the return you receive from the bank for keeping your money with them. The interest rate is usually expressed annually and can vary depending on the bank and the type of savings account you have.

How Do Interest Rates For Savings Accounts Affect My Savings?

Higher interest rates for savings accounts mean that you earn more money on your savings over time. This can boost your savings and help them grow faster. On the other hand, lower interest rates mean slower growth for your savings. It’s important to compare interest rates when choosing a savings account to maximize your earnings.

Are The Interest Rates For Savings Accounts Fixed Or Variable?

Interest rates for savings accounts can be either fixed or variable. Fixed interest rates remain the same throughout a specific period of time, usually for the term of a savings account. Variable interest rates, on the other hand, can change over time based on market conditions or the bank’s discretion. It’s important to consider whether you prefer the stability of a fixed rate or the potential for higher returns with a variable rate.

Can The Interest Rate On My Savings Account Change?

Yes, the interest rate on your savings account can change. While some savings accounts offer fixed interest rates, others may have variable rates that can fluctuate over time. Variable rates can be influenced by factors such as changes in the market or the bank’s own policies. It’s important to stay informed about any potential changes to your savings account’s interest rate.

What Factors Should I Consider When Choosing A Savings Account With A Good Interest Rate?

When choosing a savings account with a good interest rate, consider factors such as the annual percentage yield (APY), any fees associated with the account, minimum balance requirements, and whether there are any conditions to earn the advertised interest rate. It’s also important to compare the interest rates offered by different banks to find the best option for your savings goals.

Related Videos – Interest Rates For Savings Accounts

Please watch the following videos to learn more about interest rates for savings accounts. These videos will provide you valuable insights and tips to help you better understand and choose the best interest rates for savings accounts.

How Does Savings Account Interest Work?

The Top 5 Savings Accounts To Generate Profits (High Yield Savings)

Top 5 Best Savings Accounts Of 2023 (Super High Yield)

Final Thoughts On Selecting The Best Interest Rates For Savings Accounts

In my experience, selecting the best interest rates for savings accounts requires careful consideration of certain factors. firstly, it’s crucial to compare rates offered by different banks or financial institutions. secondly, assess whether the rate is fixed or variable, as this can impact your savings in the long run. additionally, keep an eye out for any fees or minimum balance requirements that may be associated with the account. lastly, don’t hesitate to reach out if you have any questions or need further assistance. i’m here to help! feel free to comment or contact me for more guidance on finding the perfect savings account for you.