As someone who has diligently researched and personally utilized various savings accounts, i understand the importance of finding the best interest rates to make your money work for you. in the ever-changing landscape of finance, it can be challenging to identify the most rewarding options for your savings. that’s why i’ve compiled a comprehensive list below, offering you the top choices for the best interest rates in 2023. whether you’re looking to grow your emergency fund or save for a long-term goal, these options will help you maximize your savings potential. so, let’s dive in and discover the best interest rates available for your savings today.

Top Picks: Best interest rates for savings 2023

Maximizing Your Money’S Potential: Unveiling The Power Of Optimal Interest Rates For Savings

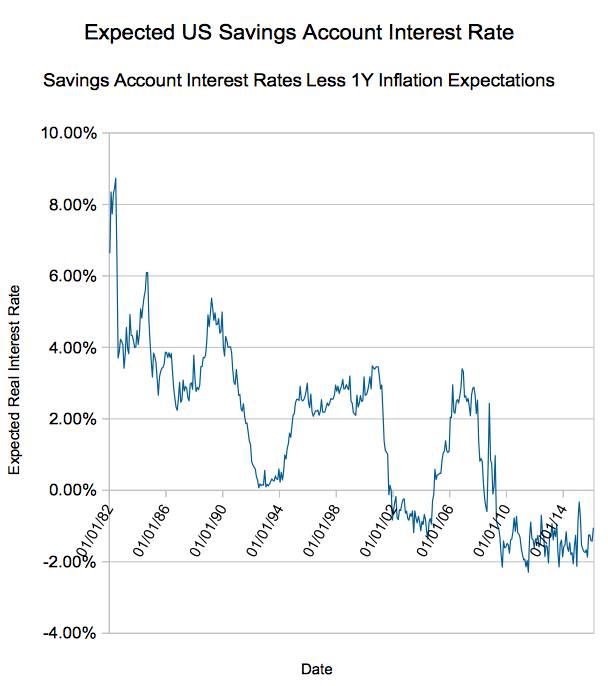

When it comes to saving money, I’ve learned that choosing the best interest rates is absolutely essential. Having tried out various savings products, I can confidently say that the interest rate you select can have a significant impact on your overall savings. Not only does it determine how much your money will grow over time, but it also affects the flexibility and accessibility of your funds. One of the first savings products I tried was a basic savings account offered by a traditional bank.

While it was convenient to have my money easily accessible, the interest rate was disappointingly low. My savings were growing at a snail’s pace, and I knew I had to find a better option. That’s when I discovered high-yield savings accounts. These accounts offer significantly higher interest rates compared to traditional savings accounts. With an online bank, I found an interest rate that was several times higher than what I was getting before.

Not only did my savings start growing faster, but I also had the convenience of online banking services. Plus, with a high-yield savings account, I was still able to access my funds whenever I needed them. Another savings product I tried was a certificate of deposit (CD). CDs offer a fixed interest rate for a specified period of time, ranging from a few months to several years. The longer the term, the higher the interest rate.

While CDs provide a higher rate of return compared to basic savings accounts, they do come with a catch – your money is locked in for the duration of the term. So, if you need immediate access to your funds, a CD may not be the best option. Overall, my experience with different interest rates for savings has taught me the importance of doing thorough research and comparing rates before making a decision. By taking the time to find the best interest rates, I’ve been able to significantly boost my savings and achieve my financial goals faster. So, whether you opt for a high-yield savings account or a certificate of deposit, make sure you choose the interest rate that works best for you and your unique saving needs..

Buying Guide For Best Interest Rates For Savings

I’ve had my fair share of experiences finding the best interest rates for savings, and I’m here to share my knowledge with you. When it comes to choosing the right savings account, it’s essential to find one that offers competitive interest rates. Here’s a helpful buying guide to make the process easier for you.

Firstly, start with some research. Take the time to compare interest rates offered by various banks and financial institutions. Online banks often offer higher rates than traditional brick-and-mortar banks, so consider looking into those as well. Make sure you take note of any special promotions or introductory rates that may be available.

Next, consider the type of account that suits your needs. Most banks offer different types of savings accounts, such as basic savings, high-yield savings, or money market accounts. High-yield savings accounts typically offer the highest interest rates, but they may require a higher minimum balance or have certain restrictions.

It’s also crucial to consider any fees associated with the account. Some banks charge monthly maintenance fees or require a minimum balance to avoid these charges. Look for a savings account that doesn’t have excessive fees, as they can eat into your interest earnings.

Another factor to consider is the accessibility of your funds. Some savings accounts provide easy access through online banking, while others may require you to visit a physical branch. Determine your preference and choose an account that aligns with your needs.

Lastly, keep an eye on the fine print. Some banks may offer enticing interest rates but impose limitations or restrictions. Read through the terms and conditions of the account carefully to ensure there are no surprises in store.

In conclusion, finding the best interest rates for savings requires some research and consideration. Compare rates, choose the right type of account, watch out for fees, consider accessibility, and read the fine print. By following these steps, you’ll be well on your way to finding the perfect savings account that offers competitive interest rates and helps you grow your savings.

Unlock Your Savings Potential: 2023’S Top 5 Best Interest Rates To Grow Your Wealth

What Is An Interest Rate For Savings?

An interest rate for savings refers to the percentage of the amount deposited into a savings account that the bank or financial institution pays back to the account holder as interest. It is the return on the money you save, typically calculated on an annual basis.

How Do Interest Rates For Savings Affect My Savings?

Higher interest rates for savings mean that your savings will grow faster over time, as the interest earned adds to your account balance. Conversely, lower interest rates will result in slower growth. Therefore, it is important to choose accounts with competitive interest rates to maximize your savings.

Are There Different Types Of Interest Rates For Savings Accounts?

Yes, there are different types of interest rates for savings accounts. The two main types are fixed interest rates and variable interest rates. Fixed rates remain the same throughout the duration of the account, while variable rates can change based on market conditions or the discretion of the bank or financial institution. It’s essential to understand the type of interest rate offered before opening a savings account.

How Can I Find The Best Interest Rates For Savings?

To find the best interest rates for savings, it is recommended to research and compare rates offered by different banks and financial institutions. Online comparison websites can be useful in this regard. Additionally, it’s a good idea to check with local credit unions or online banks, as they sometimes offer higher interest rates than traditional brick-and-mortar banks.

Are There Any Risks Associated With High-Interest Savings Accounts?

High-interest savings accounts generally carry minimal risks, as they are typically insured by government entities such as the Federal Deposit Insurance Corporation (FDIC) in the United States or the Financial Services Compensation Scheme (FSCS) in the United Kingdom. However, it is important to review the terms and conditions of the account to ensure that there are no hidden fees or limitations that could potentially impact your earnings.

Related Videos – Interest Rates For Savings

Please watch the following videos to learn more about interest rates for savings. These videos will provide you valuable insights and tips to help you better understand and choose the best interest rates for savings.

How Does Savings Account Interest Work?

Final Thoughts On Selecting The Best Interest Rates For Savings

In my experience, selecting the best interest rates for savings is crucial for maximizing your earnings. when choosing a product, it is essential to consider factors such as the annual percentage yield (apy), fees, minimum balances, and accessibility. don’t forget to check whether the rate is fixed or variable and if there are any promotional offers available. by carefully assessing these factors, you can make an informed decision that aligns with your financial goals. if you have any questions or need further assistance, please feel free to comment or contact me. i’m here to help!